Agency Triage Part One: Assessment

TL;DR

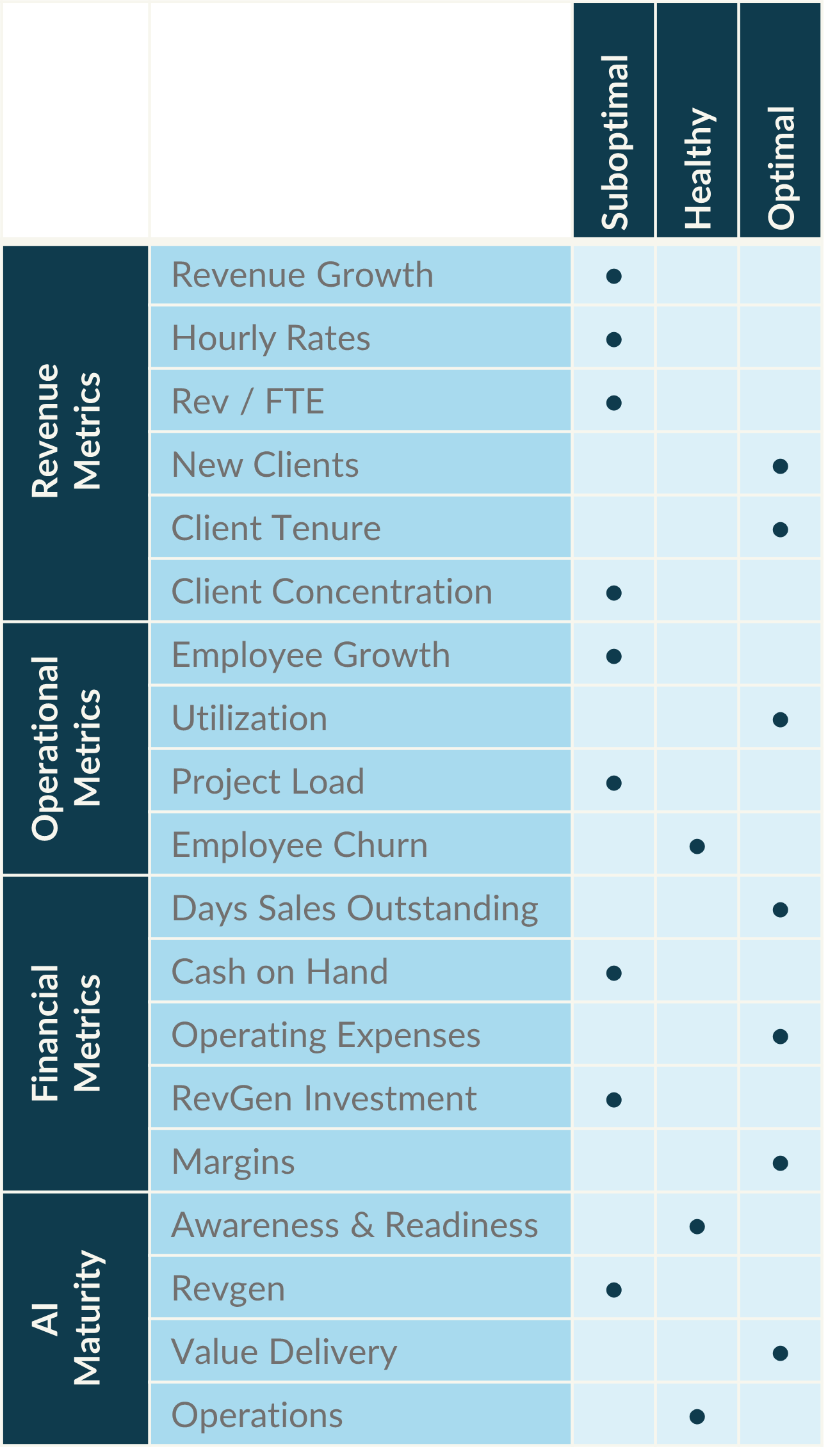

Agency Triage: Part One AssessmentThe easiest way to identify issues at an agency is benchmarking. It’s one of the first steps I take when building growth strategies because it tells me where to dig deeper. Here’s what I evaluate, some questions I ask, and some notes on implications: RevgenRevenue growth

Hourly rates

Rev/FTE

New clients

Client tenure

Client concentration

OperationsEmployee growth

Utilization

Project load

Employee churn

FinancialDays sales outstanding

Cash on hand

Operating expenses

Revgen investment level

Margins

That’s not an exhaustive list, and it’s not meant to be. We’re doing the initial tirage here. We need a high-level scan to guide the next level of evaluation. After doing this 100+ times over the last decade, this list has surfaced a lot. Where to Find the DataUnfortunately, quality data on these isn’t easy to come by. This is the main reason why Promethean exists. Back when we started in 2015, there was even less available. I published some data in a previous newsletter. Then, there’s our industry primer, which has more and a number of time series for historical reference. Finally, we do a State of Digital Services Study annually that hits most of the high points. (keep an eye out; we’re fielding this year’s study in a few weeks). Those should get you most of the way there. After saying “I used to offer benchmarking” in my last newsletter, I received a few replies asking when I’d reopen the service. The issue is that it’s a fully manual process. I’d spend a sizable amount of time assessing each metric and then evaluating them as a whole so I could provide actionable guidance. That said, I’m not reopening the service broadly. However, if you’re reading this newsletter and need benchmarks to help triage your agency, reply to this email, and we’ll set something up. It'll follow our standard benchmarking service, and you can find all the details here. What if We Don't Track Those?Some shops, especially those needing tirage, aren’t tracking many of these metrics. What to do in that case will have to wait until Agency Triage Part Two: Revgen. The spoiler's in the title. Start with (profitable) revgen. I'll dig into some of the core components of agency revgen and tests you can run to see how your agency stacks up. ✌️Until next time, - Nick |

Research & Strategy for Digital Agencies

The latest research, insights, tools, and resources that make managing a digital shop easier,

TL;DR We're presenting our latest research on how agencies can increase client lifetime value with Tucows OpenSRS on 11/20! Last call for our Future of Web survey! Participate before it closes EOD Friday. (Delphi members, be sure to use your Delphi link from this morning's email) GatherUp hired us to do an independent study on the ROI potential of reputation management. We evaluated 91 digital agencies and benchmarked them against our industry standards to create a financial model that...

TL;DR Delphi's first paid survey is live! Agency leaders can sign up, get the quarterly pulse results, and participate in optional paid research opportunities. We target a compensation rate of ~$500/hr for valid leader responses. Planning for the future can be a luxury, but when you're ready, there are ways to do it that are more successful than others. The first issue is when agencies overindex on their core business lines without investing in future services. Instability in core agency ops...

TL;DR We're live with a new playbook to help agency leaders build a referral system that works. Thanks to GoDaddy for sponsoring, this playbook is free! The 4Q Agency Pulse Survey is closed, but we'll share the results with every Delphi member, regardless of participation status! This is a one-time thing for everyone to see what Delphi is all about. Sign up and get the results. There’s been a strong undercurrent of “wtf do we do next?” throughout the agency space this year. It's causing too...